Moderna (NASDAQ:MRNA) shares traded for more than $450 last summer. But today the stock is trading at $136 – less than a third of its pandemic peak. The vaccine-maker stock gained massively during the pandemic. Its mRNA vaccine was favoured by governments around the world, including in the US and EU. In fact, its shot was famously touted as the Rolls-Royce of vaccines, although it was also linked with very rare cases of myocarditis that perhaps caused it to be less popular than the Pfizer vaccine by those being vaccinated. Prior to the pandemic, the Massachusetts-based firm was trading for less than $15 a share.

But what comes next for Moderna? Will it return to its 2021-highs, or will it continue to fall?

Why is the share price falling?

Moderna only has one commercial product and that’s its lifesaving Covid-19 vaccine, Spikevax. The shot received emergency approval around the world in 2020 and 2021 and is considered one of the most effective vaccines in the fight against Covid-19. Like other vaccines, Spikevax was developed and approved on an accelerated schedule. While it is normal for vaccine development to take a decade from discovery to rollout, Spikevax was created and rolled out within a year.

ADVERTISEMENT

These exceptional circumstances propelled Moderna from a company that most people had never heard of, to a household name worldwide. Its shot was one of the first four vaccines approved for use against the virus in the West. The other vaccines included the AstraZeneca shot that was sold for cost-price by the Anglo-Swedish drugs company. However, the Moderna vaccine was sold, and continues to be, for around $20-25 a dose.

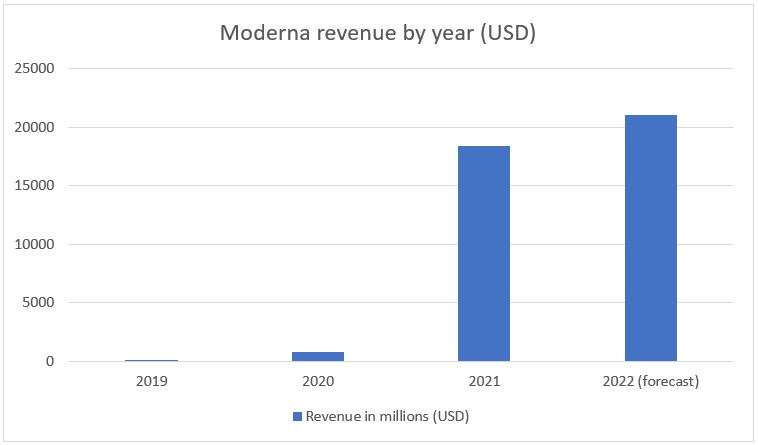

In turn, this saw Moderna generate $18.4bn in 2021. The figure represents an enormous 2191% jump from 2020. In 2020, the vaccine maker saw revenues of $803m. This figure also represented a huge 1234% increase from the $60m generated in 2019. As such, we can see how the pandemic generated revenue growth in a way which is not likely to be repeated.

Moderna has strong forecasts for 2022, but the future is uncertain after that. The firm, which currently has a market cap of $55bn, says it is on track to deliver $21bn in revenue in 2022. However, forecasts from then on are mixed. While the general forecast is steeply downwards. Some analysts have predicted that Moderna’s vaccine sales will dip as low as $2bn in 2024.

ADVERTISEMENT

So, investors are clearly concerned about revenue generation in years to come. And I think as we look around us, we can see that demand for Covid-19 vaccines is dropping. Not only among governments, but among normal citizens. Only elderly members of the British public are being offered fourth jabs right now and I’m not sure whether younger members of the population will be given free Covid-19 shots again.

What could send the share price upwards?

The less virulent nature of the Omicron strain has made vaccinations less vital. While Omicron is considerably more contagious than previous variants, it causes less severe symptoms. One thing that would send the Moderna share price soaring is the emergence of a more virulent strain, which would incentivise more vaccination. However, viruses don’t tend to evolve to become more deadly. The most successful viruses are the ones that spread, not the ones that kill their hosts.

The second thing that could reverse the negative trend in the share price is the development or launch of new products with commercial potential. mRNA technology has been lauded as having the capacity to be more easily manufactured to take on diseases such as cancer. However, the majority of Moderna’s vaccines in development concern Covid-19 and other respiratory viruses.

ADVERTISEMENT

Moderna has two combined respiratory-virus vaccine candidates in its pipeline. One targets influenza and Covid-19. The other targets flu, Covid-19, and respiratory syncytial virus (RSV). Both candidates are in preclinical development. This sort of product could enhance the firm’s revenue generation capability, but it seems unlikely that such vaccines would be rolled out to whole populations. Instead, it would be targeted at the most vulnerable, probably just in time for the winter months. However, competitor Novavax is slightly closer to commercialising a similar product.

Moderna also has a Cytomegalovirus (CMV) vaccine in phase three trials. CMV is related to the herpes virus that causes cold sores and chickenpox. However, once you have the virus, you retain it for life. It can cause serious health problems in some babies who get the virus before birth and in adults with weakened immune systems.

The biotech firm is also developing a Zika vaccine and a personalized cancer vaccine (PCV). The PCV is in phase two trials and such vaccines, if successful, are likely to be very lucrative. The disease is one of the biggest killers worldwide and treatment can be very costly. Moderna is also working on a HIV vaccine. However, many of Moderna’s vaccines are still some distance from commercialisation. Reaching commercialisation can take a decade or longer.

Valuation

Because of the uncertain future, Moderna looks very cheap by some metrics. The biotech firm has a price-to-earnings (P/E) ratio of just four, based on its profits over the past 12 months. It also has a price-to-sales ratio of just 2.4. Moderna’s valuation is quite unique in many respects. Growth stocks tend to be expensive as they’re partially valued on future revenue potential rather than their current earnings. However, Moderna growth appears to have been short-lived, and it seems unlikely that such revenue growth can be repeated in the future. With peak demand for Covid-19 vaccines likely past, an increase in the share price, at least in the short term, seems unlikely. However, I don’t see the stock’s share price falling much further. One forecast suggests that Moderna’s profits could fall to $2bn in 2024. If the market cap remained the same as it is today, $2bn in profit would give Moderna a P/E ratio of around 27 in 2024. That’s still expensive by some metrics, but biotech firms tend to trade at a premium given their valuation reflects future earnings potential. And Moderna clearly has some potential beyond its current Covid jab.

Bonus Tip: Consider doing fun and different activities every day. This has proven to be a very strong point for many people to turn their day around. Try adding small elements to your daily routine that will have a tiny positive effect on your life. Watching a funny video, reading an inspirational quote, and visiting fun sites like fortune-telling websites, could have a positive effect on your life.