On Monday evening, after the close of trading, Yalla Group (NYSE:YALA) released its financial results for the third quarter that ended September 30. Once again, the Dubai-headquartered company did not disappoint with earnings and revenue pointing upwards quarter-on-quarter. Fundamental data for the leading voice-centric social networking and entertainment platform in the Middle East and North Africa improved across the board.

Yalla’s growth comes as other established companies in the social media and entertainment space struggle. In the three months to September 30, Meta’s revenue fell 4.47% year-on-year, while net income dropped 52.2% – the Silicon Valley company posted its first sales decline as a public company.

However, the tough operating environment hasn’t proven too challenging for Yalla Group which runs a voice-centric group chat platform – Yalla – and Yalla Ludo, a casual gaming application featuring online versions of board games.

ADVERTISEMENT

Historical performance

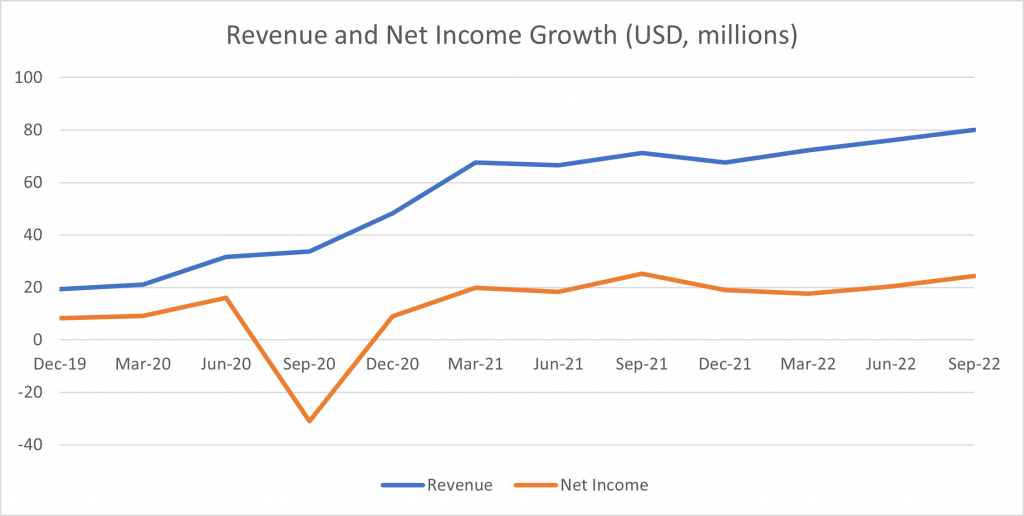

Over the past 18 months, the downward trajectory of the share price has not reflected the upward trend in revenue generation. In February 2021, the entertainment stock reached nearly $40 a share, before falling to around $4 a share today.

The collapse came as investors voiced their concerns that social media companies, as well as other entertainment firms, would struggle to continue growing at the same rate beyond the pandemic. Even hard tech firms, like NIO, Li Auto, and Rivian, saw their share prices plummet.

Another positive quarter for revenue

On Monday, Yalla announced that revenue for the third quarter was $80.1 million, representing an increase of 12.3% from the third quarter of 2021. The growth also represents a four million dollar increase from the second quarter of 2022 ($76.1 million), and 5.2% growth. The revenue recorded is nearly a 10% increase on the $72.3 million achieved in the three months to the end of March.

ADVERTISEMENT

Yalla’s management put the increase down to relentless efforts to refine operational processes and optimize user acquisition. “During the quarter, we continued to enhance our product portfolio with gamification and entertainment features to comprehensively strengthen user engagement,” said Yang Tao, Founder, Chairman and CEO of Yalla.

Chatting services is still by far the largest revenue stream, generating $56.2 million during the quarter. Revenues generated from games services in the third quarter came in at $23.9 million. In Q2, revenues generated from chatting services were $52.7 million, while revenues from gaming accounted for $23.3 million. As such, we can see that greater quarter-on-quarter revenue growth came from chatting services.

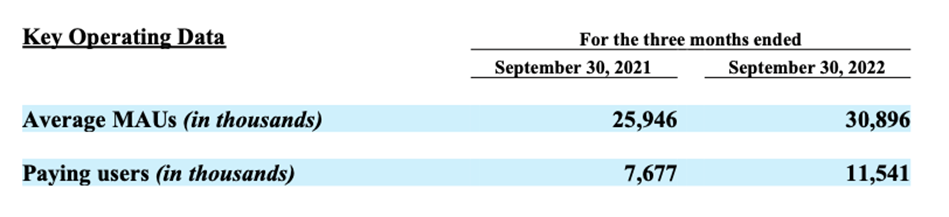

The growth in revenue has been accompanied by a rise in Monthly Active Users (MAUs). Average MAUs increased to 30.9m during the three months, up 19.1% from 25.9 million in the third quarter of 2021. But most importantly, Yalla has been successful in turning traffic into paying users, with a 50.3% year-over-year growth in paying users. Some 11.5 million people now pay to use Yalla’s platforms.

ADVERTISEMENT

Net income falls YOY on higher spending

Net income for the third quarter came in at $24.4 million, down from $25.3 million in the third quarter of 2021. However, this largely reflects higher spending on customer acquisition. Despite this, Q3 net income is higher than that achieved in the second quarter – $20.4 million.

Meanwhile, non-GAAP net income was $29.4 million in Q3, compared with $33.2 million in the third quarter of 2021, also highlighting the fall in profits. The firm achieved a net margin of 30.5% in the Q3, and excluding share-based compensation, a non-GAAP net margin of 36.7%. That’s up from a net margin of 26.7% during the second quarter.

As a result, third quarter non-GAAP basic and diluted earnings per share (EPS) fell accordingly to $0.19 and $0.17 respectively from $0.22 and $0.18 in the same period of 2021.

With revenue rising, lower net income and EPS can be attributed to higher costs. Total costs and expenses for the quarter came in at $55.6 million, compared with $45.6 million in the third quarter of 2021. The increase in costs can be seen across the board.

- Cost of revenues increased to $29.6 million in Q3, a 26.3% increase from $23.4 million in the same period last year.

- Selling and marketing expenses were $12.0 million in Q3, a 9.0% increase from $11.0 million in the same period last year.

- General and administrative expenses were $8.6 million in Q3, a 16.9% increase from $7.3 million in the same period last year.

- Technology and product development expenses were $5.5 million in Q3, a 42.2% increase from $3.9 million in the same period last year.

Analysis

Investors will be glad to see three quarters of consecutive revenue growth, after revenue appeared to be plateauing in 2021 – in fact, in two quarters of 2021, revenue had gone backwards.

The continued growth comes amid a challenging economic backdrop. One in which firms around the world appear to be cutting back social media marketing spending and as the global economy opens up, physically, following the pandemic.

The former factor has resulted in big tech companies severely underperforming and even cutting staff numbers. Meta, which owns Facebook, Instagram and WhatsApp, has recently announced that it will cut 13% of its workforce. Twitter has reportedly slashed its workforce by nearly 50% following the Elon Musk takeover – the company is only occasionally profitable at the best of times.

The latter – the opening up of the economies following the pandemic – has generally resulted in a shift away from social media usage, as café, shops and restaurants reopen. People have been more inclined to enjoy the physical world rather than the virtual world since restrictions were removed.

One factor that may be aiding Yalla right now is the strength of the MENA economy. While many Western nations are facing recessions, and Chinese growth appears to be slowing, World Bank economists forecast that the Middle East and North Africa (MENA) region will grow by 5.5% in 2022 (the fastest rate since 2016).

It’s also positive to see a company investing in growth without a sizeable reduction in profitability or increasing debt levels – in fact Yalla Group had cash and cash equivalents of $391.2 million at the end of Q3, up from $384.9 million as of June 30. The cost of revenues as a percentage of total revenues increased from 32.8% in the third quarter of 2021 to 36.9% in the third quarter of 2022, but overall margins remain positive.

Yalla is in a fairly unique position in that it is a profit-making growth stock with very considerable cash reserves. The firm is clearly well-positioned for further growth due to the strength of its fundamental data. However, the success of the growth project will depend on the company’s capacity to monetize its platform and draw in more users.

The value of its cash and cash equivalents also can’t be understated at this moment in time. With interest rates rising around the globe, many growth stocks will be faced with the choice of postponing development projects or taking out loans with higher repayments. Equally, it’s worth noting that Yalla’s market cap is currently around $610 million and is therefore approximately only $220 million greater than the value of the firm’s cash and cash equivalents. The figure is equivalent to Yalla’s project earnings for the next two years.

The voice-centric social networking and entertainment platform doesn’t look expensive by several metrics. It has a price-to-earnings ratio of 6.01, versus a sector average of 12.8, while its price-to-sales ratio is 2.14, above the industry average of 1.24. And given the size of its net cash position, it has an enterprise value-to-sales ratio of 0.72 versus a sector median of 1.95. Collectively, these metrics look positive.

Taking into account the sector median enterprise value-to-sales, along with other factors, including the strength of the MENA market and Yalla’s product, I’m expecting to see the share price push upwards in the coming months towards $6 a share. This would bring the EV / share ratio closer in line with the sector average.

Yalla’s view

CEO Yang said the company was “delighted” with its Q3 performance, highlighting the 50.3% growth in paying users. But Yang also touted developments in its application offering. “Alongside our ongoing efforts to promote our flagship applications, we made meaningful progress on our new initiatives during the third quarter. Notably, we rolled out the beta version of our first hard-core mobile game, “Merge Kingdom,” a milestone for Yalla Game,” Yang said in a statement. The founder said the company remained committed to “augmenting the Yalla ecosystem and delivering compelling user experiences to fulfil users’ diverse demands and provide the people of MENA with better access to a digital life.” By doing so, Yalla hopes to become the region’s most popular destination for online social networking and entertainment.