Someone in your life, perhaps your lover or best friend, is discussing cryptocurrency. Maybe you heard about it in the news or on social media. In any case, you’ll want to learn more about this new technology that people are advising you to invest in. Here, we’ll look at what a cryptocurrency is and how it works. Let’s get started with some definitions.

What are blockchain and cryptocurrency?

At its most basic level, a cryptocurrency is a digital asset that uses computer code and blockchain technology to run autonomously, without the need for a significant party to control the system, such as a person, company, central bank, or government.

A blockchain is a distributed ledger that records bitcoin transactions. A distributed network of computers maintains this transaction ledger. In bitcoin protocols, transactions are aggregated into blocks, linked together to create a historical record of everything that has transpired on that blockchain.

ADVERTISEMENT

Bitcoin, the first cryptocurrency, was founded to serve as an online payment system. Faster, cheaper, censorship-resistant, and not subject to the whims of any government or central bank.

What are the types of cryptocurrency?

Coins and tokens are the two types of cryptocurrencies. Coins run on their blockchain and have value because they are utilized as a medium of exchange. Tokens, on the other hand, are based on a previously established blockchain.

Ethereum

Ethereum is a cryptocurrency network that facilitates intelligent contracts by utilizing blockchain technology. It is a decentralized program that allows smart contracts to be developed and deployed on its network without third-party oversight or fear of fraud.

ADVERTISEMENT

Dogecoin

A popular meme-inspired this cryptocurrency with a Shiba Inu dog as its symbol. The meme went viral, as did the cryptocurrency, which saw its price jump after supporting Tesla CEO Elon Musk. Musk’s support for the meme coin has caused a stir in the already volatile crypto market. Unlike Bitcoin, Dogecoin has no limit on how many coins may be mined.

Litecoin (LTC)

It was founded in 2011 by Charlie Lee, a Google engineer, and MIT graduate. It was one of the first few cryptocurrencies that use Bitcoin’s technology. Despite being modeled after Bitcoin, Litecoin generates blocks quicker and provides a faster transaction speed.

Important advantages of cryptocurrencies

Still not convinced that cryptocurrencies (or any other form of decentralized money) are a better option than a traditional government-issued currency? Because of their decentralized structure, cryptocurrencies may be able to supply a variety of solutions:

ADVERTISEMENT

Reducing corruption: Cryptocurrencies aim to overcome the problem of absolute power by dividing it among many persons or, better yet, across all network participants. Blockchain technology is based on this concept.

Cutting away the middleman:

With traditional money, a middleman such as your bank or a digital payment firm takes a cut every time you make a transfer. All network participants in the blockchain are middlemen with bitcoins; their compensation is phrased differently and is consequently modest in contrast.

Giving people control over their own money:

When you use traditional cash, you’re essentially handing over control to central banks and the government. You and only you have access to your funds when you use cryptocurrency.

What are the dangers of cryptocurrency use?

Cryptocurrencies are still in their infancy, and the market for them is pretty volatile. Cryptocurrencies are uninsured and challenging to convert into real currency because banks or other third parties do not regulate them.

Furthermore, because cryptocurrencies are intangible technology assets based on technology, they can be hacked like any other supernatural technology asset. Finally, because your cryptocurrencies are stored in a digital wallet, you will lose your entire cryptocurrency investment if you lose your wallet (or access to it or backup wallets).

To protect your cryptocurrency, follow these guidelines:

Before you jump, take a look around!

Be sure you understand how a cryptocurrency works, where it can be used, and how to swap it before you invest. Please read up on the currency’s website (such as Ethereum, Bitcoin, or Litecoin) to better understand how it operates.

Have a backup plan in place.

Consider what would happen if your computer or mobile device (or wherever you keep your wallet) was lost or stolen, or if you didn’t have access to it anyway. For example, you will be unable to recover your cryptocurrency without a backup solution.

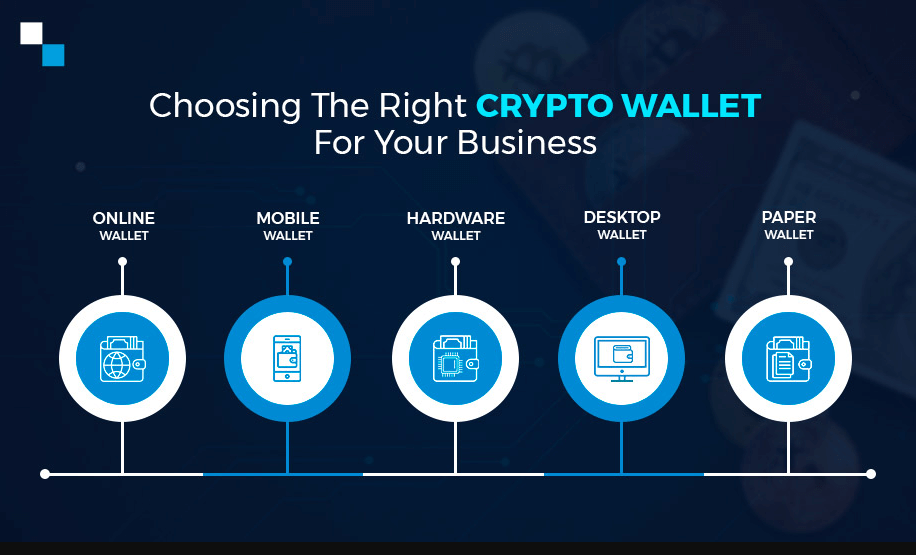

Use a secure wallet.

Choosing the best wallet for your needs will necessitate some study on your behalf. Choose to handle your cryptocurrency wallet with a local application on your computer or mobile device. You must ensure that it is protected to the same level as your investment. It would help if you used a reputable wallet.

Find Out More!

To summarise, while cryptocurrencies are more convenient than traditional banking and investment options, they are not as secure as using a local bank. It’s easy to get caught up in the latest and most significant currencies, finance, and investment opportunities, but making wise decisions about your future requires careful consideration. The best places to start are gathering information and engaging with seasoned individuals who have the know-how and knowledge to guide you properly.

Procommun Suggestions

procommun.com