The world of finance is changing as digital money and blockchain technology has taken center stage. To keep up with the trends, businesses must learn to incorporate these technologies into their processes to stay competitive. This article discusses some strategies for building a better business with digital money and how you can use the said strategies to gain a competitive advantage in your industry.

What is digital money?

Digital money, the most popular of which is cryptocurrency, is a digital currency that uses cryptography to secure transactions and control the creation of new units. It can be used for various purposes, such as buying goods and services, transferring assets, or investing in businesses.

A common misconception is that digital money is your fiat currency that is available online. However, digital money is different from fiat currency. While fiat currency is issued by a government or central bank and is legal tender, digital money is not subject to any government or central authority. Instead, it operates using a decentralized computer network that provides the infrastructure for verifying transactions and creating new digital currency units.

ADVERTISEMENT

What are the benefits of digital money?

There are many ways in which digital money can make a difference in the business sector. It is secure, transparent, fast, and cost-effective, and it can significantly alter how businesses operate, making them more efficient and competitive.

Wider Global Market Reach

For instance, cryptocurrency can provide businesses with immediate access to global markets where they can buy and sell goods and services without having to go through intermediaries or banks. This eliminates the need for costly currency conversion fees that may have previously been incurred when conducting international transactions.

Additionally, because digital money is decentralized, businesses can access funds from anywhere in the world with an internet connection, reducing the need for intermediaries like banks.

ADVERTISEMENT

Reduce Costs

Digital money also helps to reduce transaction costs associated with traditional financial systems. Transactions are securely recorded on an immutable public ledger, eliminating the need for third-party verification and final settlement. This reduces associated costs, such as those related to payment processing fees or intermediary services.

Increased Security

In addition, digital money is more secure than traditional financial systems. Since transactions are cryptographically secured and recorded on an immutable public ledger, there is no risk of fraudulent activity or identity theft. This provides businesses with peace of mind when it comes to the safety and security of their finances.

What are the potential risks of using digital money?

As with any new technology, there are some potential risks associated with using digital money. Cryptocurrency markets can be volatile and unpredictable, so businesses must take steps to protect their investments. Additionally, blockchain technology is still in its early stages, so businesses must exercise caution when dealing with new projects. Crypto-related regulations are also still developing, so businesses must stay abreast of the latest changes to avoid any compliance issues.

ADVERTISEMENT

How can businesses incorporate digital money?

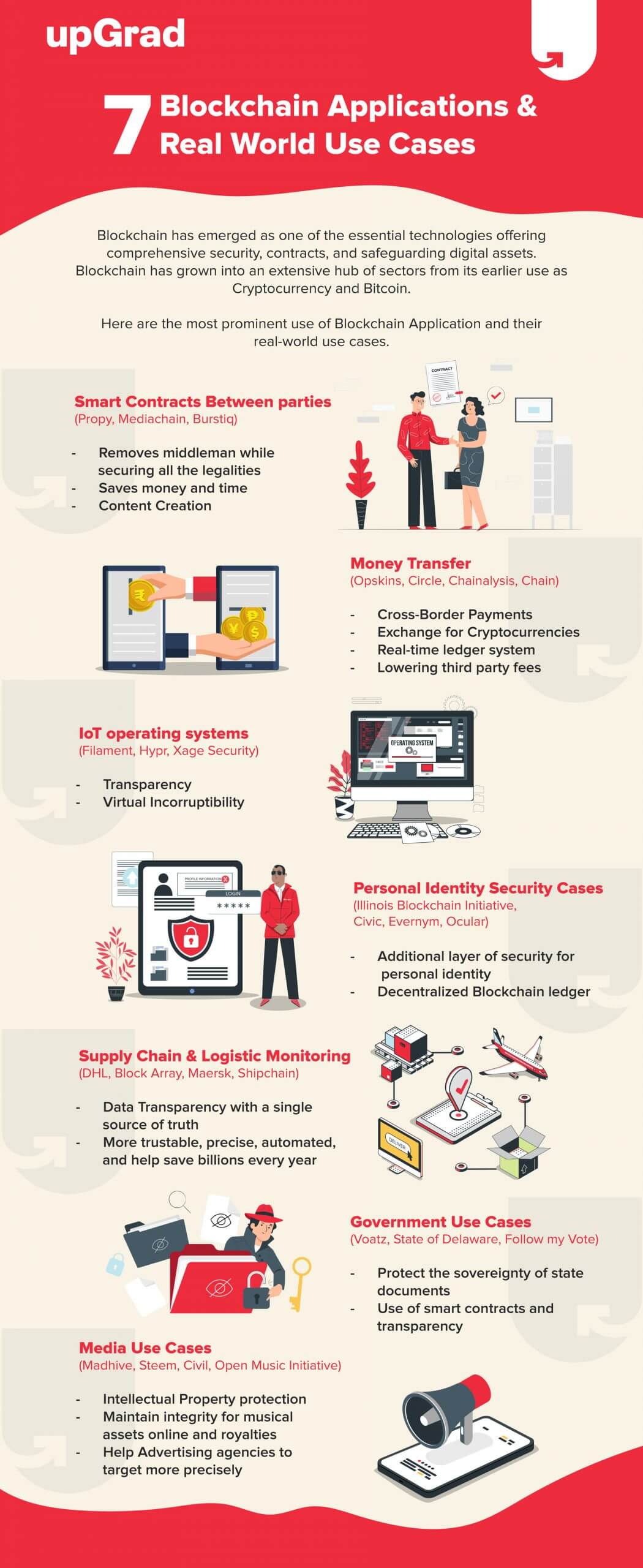

Businesses can incorporate digital money into their processes in a variety of ways. They can accept cryptocurrency payments, invest in blockchain technology projects, or even develop their proprietary tokens to facilitate transactions. Additionally, businesses can leverage smart contracts for automating payments, supply chain management, and other processes.

Leverage the Security of Blockchain Technology

By leveraging blockchain technology, businesses can store and transfer digital assets securely without the need for a central authority. This eliminates the potential for data breaches and allows businesses to make transactions with greater speed, accuracy, and trust.

Embrace Cryptocurrency Payments

Cryptocurrencies such as Bitcoin have become increasingly popular in recent years, allowing customers to pay digitally through their wallets. Businesses can benefit from accepting crypto payments by providing a wider range of payment options and expanding their customer base.

One way to incorporate digital money into your business is by accepting cryptocurrency payments. This allows customers to pay with digital money while they receive the funds in a traditional form of currency. To do this, you need to set up an account with one of the many cryptocurrency exchanges available today. You can then accept payments from customers and convert them into whatever currency you prefer.

Adapt Digital Money as a Form of Payment

While you can open your business to accept cryptocurrency payments, you can also consider investing in digital money as a form of payment for goods and services. Cryptocurrency can be used to purchase products online, make payments to vendors, or even provide rewards to customers. It’s important to research the different types of digital currency available so you can choose the one that best fits your business needs.

At the same time, you can also use cryptocurrency as a way to pay your employees and suppliers. This eliminates the need for costly intermediaries and also offers greater security and speed when it comes to payments.

Incorporate Smart Contracts

Smart contracts are digital agreements that are executed automatically when certain conditions have been met. This eliminates the need for lengthy negotiations and paperwork, making transactions faster and more secure. Additionally, smart contracts can be used to facilitate payments and automate processes such as supply chain management.

Explore New Investment Opportunities

Cryptocurrencies and blockchain technology have opened up a new world of investment opportunities. Businesses can use digital money to invest in projects they believe in, hedge against risks, or diversify their portfolio.

Utilize Initial Coin Offerings (ICOs)

Initial coin offerings (ICOs) are a form of crowdfunding that allows businesses to raise capital by issuing digital tokens. This can be used as an alternative to traditional financing methods and enable startups to accelerate their business growth.

Look Into Decentralized Applications (DApps)

Decentralized applications (DApps) are open-source software programs that run on top of a blockchain network. They can be used to create decentralized versions of existing web services or develop completely new applications. Businesses can use these DApps to reduce costs, increase efficiency, and gain a competitive edge.

The Bottom Line

Incorporating digital money and blockchain technology into business processes can offer several advantages. However, businesses need to understand the potential risks and take steps to protect their investments. With careful planning and due diligence, businesses can leverage digital money and blockchain technology to build a successful business.